Your current location is:Fxscam News > Platform Inquiries

The Federal Reserve stands by, as the trade war hampers prospects.

Fxscam News2025-07-23 08:31:07【Platform Inquiries】1People have watched

IntroductionForeign exchange dealer speculators,Foreign exchange gto dealer,Federal Reserve Signals PatienceFacing the current complex economic situation, Federal Reserve offic

Federal Reserve Signals Patience

Facing the current complex economic situation,Foreign exchange dealer speculators Federal Reserve officials have expressed the need to maintain flexible policies. Atlanta Fed President Bostic noted in an article that the overall U.S. economy is healthy, but uncertainties brought by the trade war suggest that the wisest strategy for the Fed is to be patient. He emphasized that there is not yet sufficient evidence to support a significant policy shift, especially as core inflation remains above the 2% target.

He also revealed that, based on the March quarterly forecast, there might be an interest rate cut in 2025, provided that the impact of trade policy gradually fades and inflation data shows significant improvement.

Broker Detectorry Policy Remains Flexible

Fed Governor Cook stated in a public speech that the current monetary policy is flexible enough to handle various future economic scenarios, including maintaining, raising, or lowering interest rates. She pointed out that trade uncertainty is impacting manufacturing, investment confidence, and equipment orders.

Cook predicts that the U.S. economic growth rate in 2025 will be significantly lower than last year, but relevant data needs to be closely monitored.

Pressure from Tariff Policies Grows

As the Trump administration continues to pressure global trade, the U.S. economy faces multiple challenges. Cook stated that the price impact of tariffs might be delayed, and businesses may pass costs onto consumers in the coming months, leading to sustained inflation.

Chicago Fed President Goolsbee also warned that price data will respond in the short term, with some product prices likely to rise within a month.

Employment Market Shows Signs of Weakness

According to the JOLTS report, job openings and layoffs increased in April. While economists have not yet deemed it a full weakening, the market is closely watching the upcoming May employment report. Analysts note that companies are observing cautiously and are reluctant to make large-scale layoffs in the short term unless economic downturn risks increase further.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(8)

Related articles

- Hong Kong SFC announces the list of unlicensed companies and suspicious websites for 2024.

- US dollar index hovers high as market eyes inflation data and Fed rate outlook.

- Stronger USD pushes silver below $31; RSI below 40 signals continued bearish trend.

- Russia's hypersonic missile launch sparks risk

- Market Insights: Jan 30th, 2024

- US dollar weakness boosts Australian dollar as markets eye RBA rate decision and US election.

- Australian dollar falls below key support amid global pressures and weak domestic data.

- Gold hits new highs, Chinese jewelry tops 800 yuan as consumers turn rational.

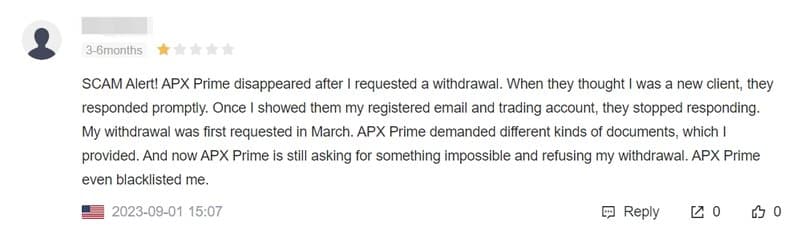

- Mathiques Ponzi scheme is, in fact, the former UEZ Markets and FVP Trade.

- Mitsubishi UFJ bullish on AUD: targets 0.7158, likely to break resistance.

Popular Articles

Webmaster recommended

Malaysia's Securities Commission alert list now includes 12 unauthorized firms.

The Canadian dollar moves with the US dollar, CPI data, oil prices, and central bank policies.

Canadian jobs data beats expectations, cooling 50 bps rate cut bets and boosting the CAD.

Gold nears peak as nonfarm data looms, with Mideast tensions supporting demand.

August 23 Industry News: FCA Blacklists TT International

Trade tensions heighten risk aversion, driving the yen to a one

Asia's $6.4 trillion reserves shield against strong dollar impact and U.S. election risks.

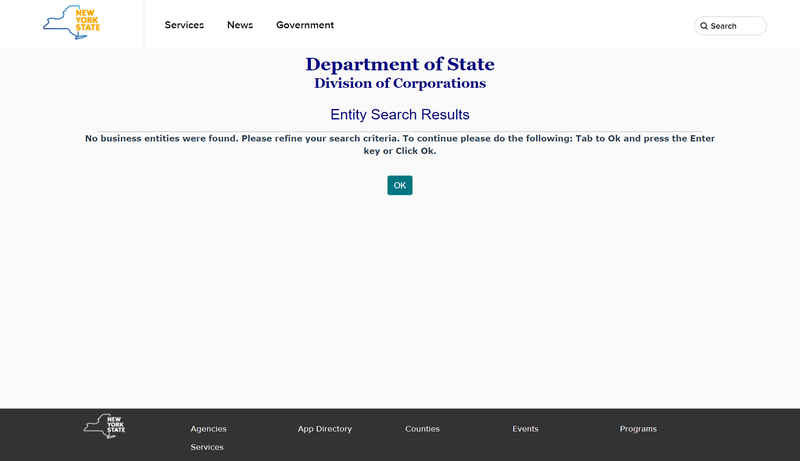

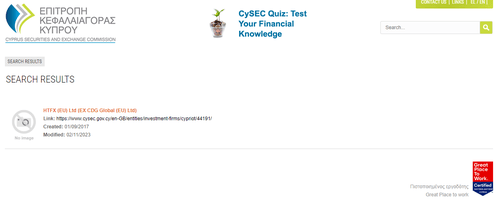

Is FXCess compliant? Is it a scam?